Zakat, Tax and Customs Authority

(ZATCA) settings

Electronic invoicing is a procedure that aims to convert the issuing of paper invoices and notes into an electronic process that allows the exchange and processing of invoices, credit notes & debit notes in a structure electronic format between buyer and seller through an integrated electronic solution.

What is an electronic invoice?

A tax invoice that is generated in a structured electronic format through electronic means. A paper invoice that converted into an electronic format through coping, scanning, or any other method is not considered an electronic invoice.

Roll-out phases

E-INVOICING (FATOORAH) IMPLEMETATION IN KSA ZATCA has published e-invoicing requirements that will be rolled-out into two main phases in KSA:

PHASE 1 (as of December 4th, 2021)

Phase 1, known as the Generation phase, will require taxpayers to generate and store tax invoices and notes through electronic solutions compliant with Phase 1 requirements. Phase 1 is enforceable as of December 4th, 2021, for all taxpayers (excluding non-resident taxpayers), and any other parties issuing tax invoices on behalf of suppliers subject to VAT.

PHASE 2 (enforceable starting January 1st, 2023, in waves)

Phase 2, known as the Integration phase and rolled-out in waves by targeted taxpayer group, will involve the introduction of Phase 2 technical and business requirements for electronic invoices and electronic solutions, and the integration of these electronic solutions with ZATCA’s systems. ZATCA will notify taxpayers of their Phase 2 wave at least six months in advance and is rolled-out in waves by taxpayer group.

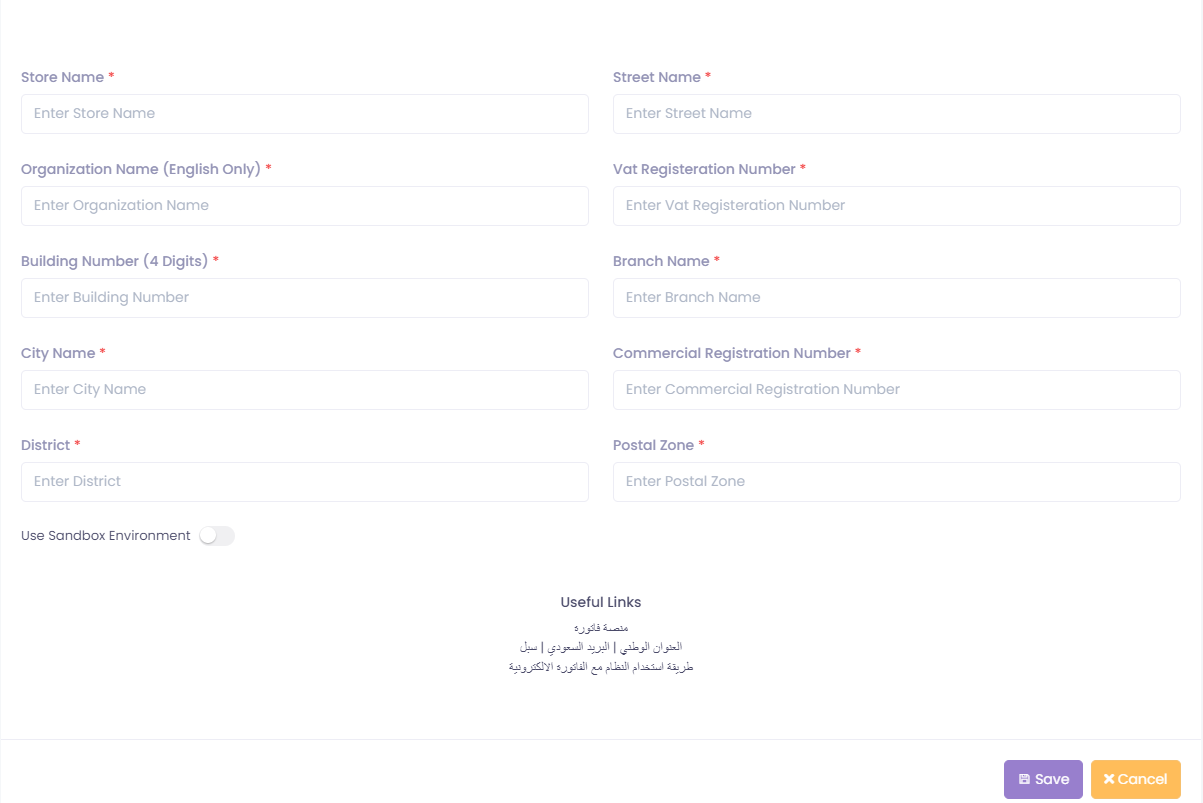

Steps to activate the second phase of the E-invoice through the Pops Enterprise:

Through the enterprise system, enter the settings section, then the linking systems, then the government systems, then choose the General Authority of Zakat, Tax and Customs.

Select the branch, then enter all the required data and then save